Mileage Allowance 2024 Ireland. Mileage allowance payments (maps) for employees. Here are the new civil service rates for mileage allowance in ireland for 2024, set by revenue, effective from 1st september 2023.

Here are the new civil service rates for mileage allowance in ireland for 2024, set by revenue, effective from 1st september 2023. A flat rate of huf 15 (€0.038) per km or petrol usage reimbursement (upon receipt).

Mileage Allowance 2024 Ireland Amii Lynsey, Repay the actual cost of the travel to your employee.

Mileage Allowance 2024 Ireland Becki Virginie, Mileage rates are applicable when an employee uses their private cars, motorcycles or bicycles for business purposes.

Mileage Allowance 2024 Ireland Jilly Lurlene, The distance between your employee's normal place of work and the temporary place of work.

Mileage Allowance 2024 Ireland Amii Lynsey, You can pay your employees' expenses when they travel on business journeys.

Irish Mileage Rates 2024 Lacie AnnaDiana, This payment can be made, tax free, by the amount of business kilometres travelled.

Mileage Allowance 2024 Ireland Gypsy Kellina, You can pay your employees' expenses when they travel on business journeys.

Civil Service Mileage Rates in Ireland for 2024 Capture Expense, The distance between your employee's normal place of work and the temporary place of work.

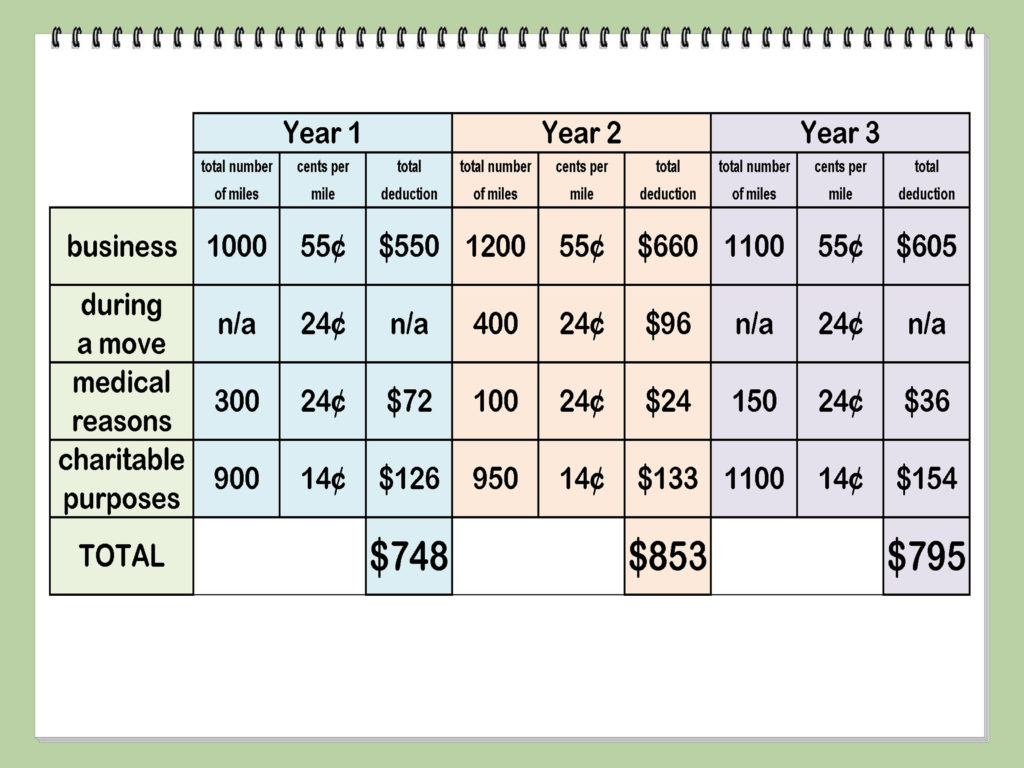

Revenue Mileage Rates 2024 Ireland Tandy Florence, Mileage allowance, on the other hand, is a separate type of allowance that covers expenses incurred by employees when using their personal vehicles for official business trips.

Fuel Allowance in Ireland 2024 Budget, Payment Dates, Eligibility, The irish civil service mileage rates for 2024 are divided into categories based on the type of vehicle, engine size, and the distance travelled.

Mileage Rate 2024 Ireland Calculator Debee Ethelyn, You can also pay subsistence if employees are working away from their normal place of work.